Keytime Payroll Director NI Calculation

An issue has been found that affects any Keytime payroll where directors' NI is calculated by using the non-cumulative method.

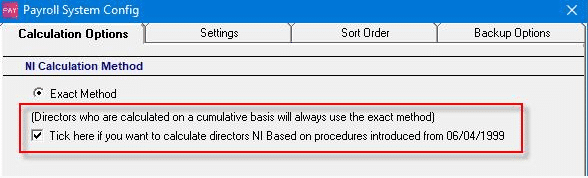

In Keytime, this would be for companies who have the ‘Tick here if you want to calculate directors NI Based on procedures introduced from 06/04/1999’ option ticked from the menu’s Setup > Configure

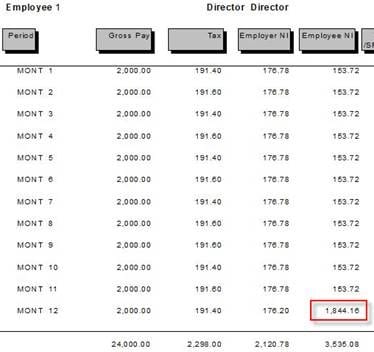

If the employee has been a director for the whole of the tax year 2019/20, when the final pay period is run, the amount of employees NI calculated will be incorrect; this is because Keytime Payroll is not taking into account any NI paid during the course of the year.

Please see below for an example, as you can see, month 12 employee NI is incorrect:

This would be visible in the following places:-

- Periodic pay – the employee’s net pay would be incorrect

- Payslip

- Payment History Report

Workaround

Following the below steps will resolve this:

- Untick the procedures introduced from 06/04/1999 basis from; Setup > Configure System > Calculation Options

- Re-calculate the final payroll run for 2019/20 tax year for any employee with this issue - this will correct the Employee NI

- Prior to running the 1st period in the new 2020/2021 tax year, re-tick the procedures introduced from 06/04/1999 basis from; Setup > Configure System > Calculation Options