Digital Tax - How to use HMRCs Pre-Population of Tax Return Data

Introduction

Keytime Personal Tax can retrieve data from HMRC either:

1. Each time you press the Retrieve button on the tax return toolbar:

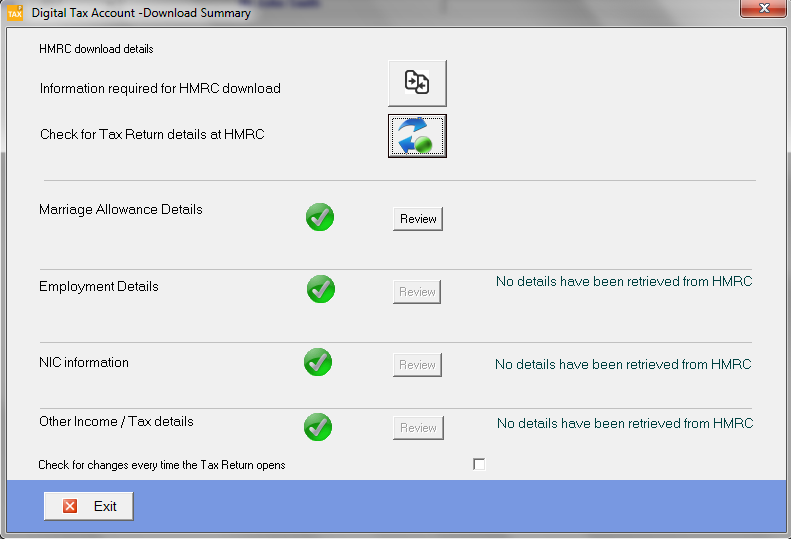

Click 'Check for tax return details at HMRC'

or

2. Each time you load a tax return. To set this up click Retrieve on the main tax return toolbar click the option in the bottom of this screen to 'Check for changes every time the tax return opens':

Granting authority for Keytime software to access taxpayer information

Before you can access the data HMRC hold on your client 2 things need to happen:

1. You need a valid 64-8 in place for the client. There is no need to resubmit 64-8s for the new service; HMRC have migrated all existing 64-8s to the new service.

2 You need to grant authority for the software to access the data. Once you have granted authority it will remain in place for a period of 18 months. Once the 18 months expires you run through the same procedure again. To grant authority proceed as follows:

1. Click Retrieve on the main tax return toolbar click Check for tax return details at HMRC you will be presented with the following screen:

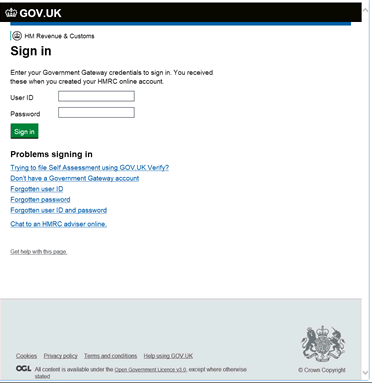

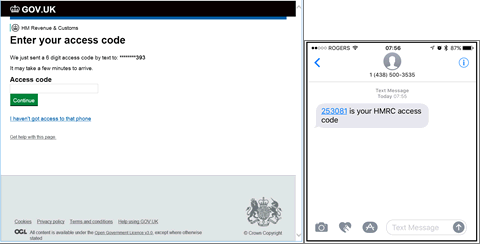

2. Enter your EXISTING Government Gateway credentials click Sign in follow the instructions on screen. This process requires two step verification which involves entering an access code sent either to a landline mobile phone number or mobile app. Follow the instructions on screen then enter your access code and click Continue:

3. Once the verification process is complete you need to grant Keytime authority to access the taxpayer data click Grant Authority.

Data is now retrieved and summarised in the digital Tax Account Summary screen.

Working with downloaded taxpayer data

Employment Data

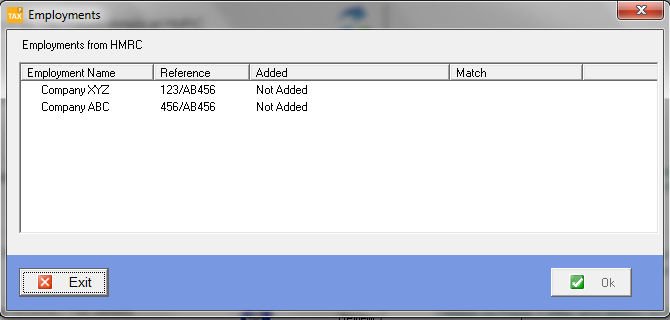

- Keytime Tax Personal will create any employments that don't already exist.

- The system will inform you where downloaded data doesn't match the existing record

Click Review to see the differences:

To add missing employments click the employment click Add the Match status at this point will state Match. The system will add any required employment pages to the return and populate the relevant boxes with earnings tax deducted and any employment benefits.

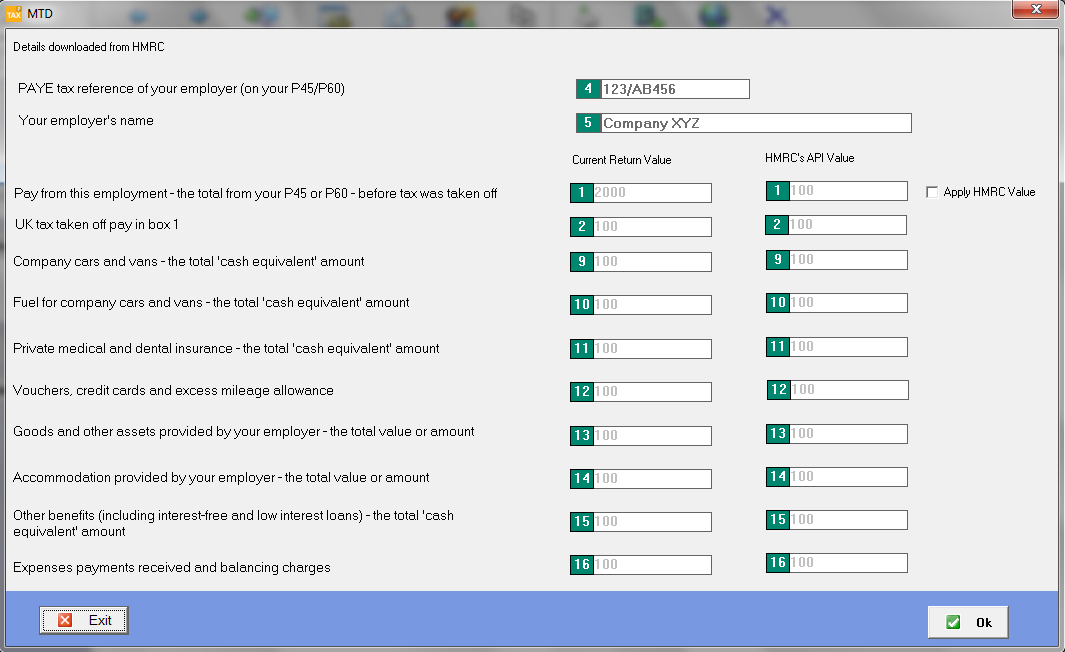

Where an employment already exists but the earnings and tax deducted are different the Match status will state 'Values are different' click the row and click View:

You can review the differences side by side with the value returned by HMRC. To use HMRCs value click 'Apply HMRC value' Click OK.

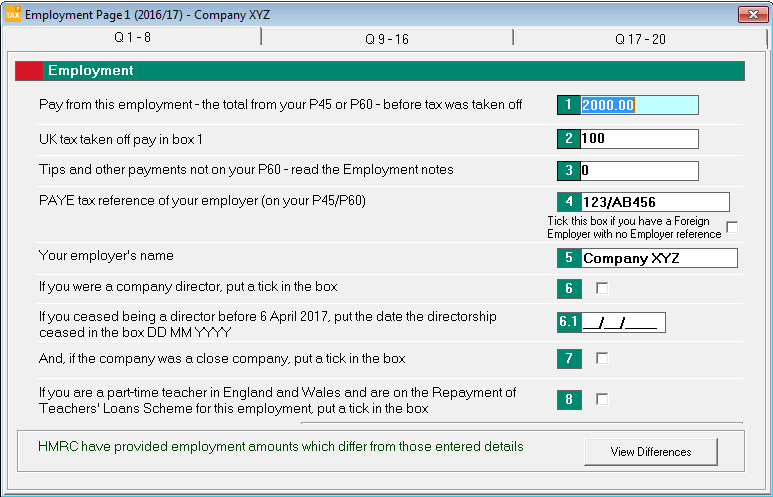

You will also be informed in the tax return pages where data differs from that downloaded from HMRC. Here is an extract from the Employment pages:

You can disregard HMRCs figures if you think they are incorrect; just populate the boxes on the return and submit as normal.

Class 2 NIC

HMRC will return a figure for class 2 NIC:

- There must be a set of self employment or partnership pages present.

- Personal Tax will calculate class 2 NICs you can choose to use HMRCs value or the system calculated value.

- If the turnover is below the calss 2 NICs threshold and you want to apply the contributions regardless tick the override box:

.png)

Pensions and state benefits

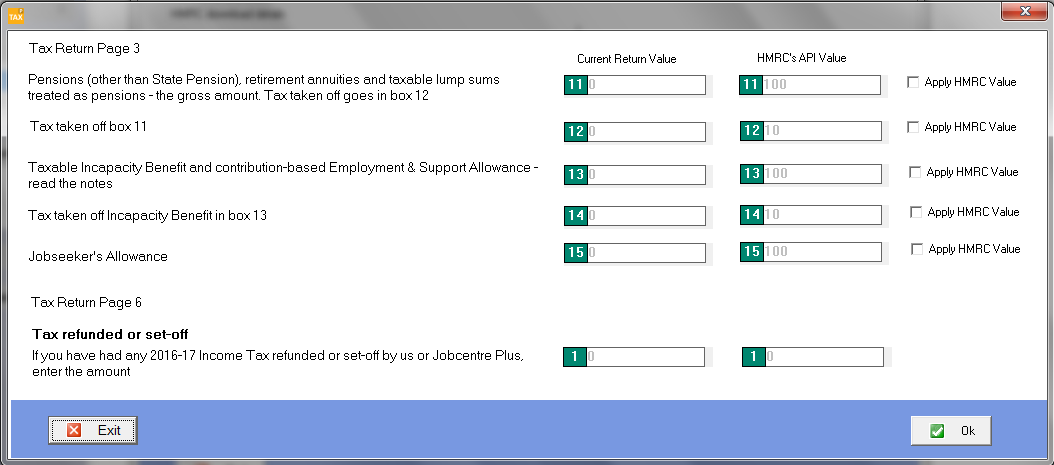

Pensions and state benefit details are returned to the Additional Information pages as with the data for the employment pages you can either use or disregard the information:

Marriage allowance

HMRC will return a marriage allowance status of either Recipient Transferor or Not Applicable

Important note about employment details benefits and pensions data

Please note that data will only be returned when it has been through a reconciliation process at HMRC. Marriage Allowance claims and Class 2 NIC values should be available immediately at the start of the tax year. However Employment details benefits and pensions will not be available until after the reconciliation process which HMRC say will be after June each year.