Changes to Partnership Format Accounts Production

Important Information About Changes to the Partnership Format

The inclusion of a breakdown of partners’ capital and current accounts in the partnership format has been a popular request; Accounts Production update 5.1.0.4 includes this enhancement. It is important that you read and retain the information contained in this article as existing partnership accounts are affected.

What’s New

- The partners’ appropriation account has been enhanced; it now includes partners’ salaries and the appropriation of the remaining profit or loss. The appropriation account now appears after the profit and loss account.

- New ledger codes have been introduced to cover partners’ capital and current accounts and the movement therein.

- The notes to the accounts now include a detailed breakdown of the movement in the capital and current accounts for each partner.

Important Information

New Ledger Codes

To enable a breakdown of capital and current accounts it has been necessary to introduce new ledger codes to the accounts. The existing codes didn't have the scope to cover the requirement and they were too closely numbered. This means we've had to rename some of the existing codes and move existing balances to the new codes; moving existing balances occurs automatically as the system is upgraded after applying the update. The table below shows how the account codes have changed and how existing balances have been moved:

Original code | New Code | Balance Moved to | Account Description |

6050 | 6050 | 6053 | Partner 1 Capital: Balance B/fwd |

6051 | 6051 | 6054 | Partner 1 Capital: Cap introduced |

| 6052 |

| Partner 1 Capital: transfers |

| 6053 |

| Partner 1 Current: Balance B/fwd |

| 6054 |

| Partner 1 Current: introductions |

| 6055 |

| Partner 1 Current: transfers |

6052 | 6056 | 6056 | Partner 1 Current: Salary |

6054 | 6057 | 6057 | Partner 1 Current: Drawings |

There is a maximum of 10 partners and each partner now has a range of 10 code numbers so partner two's code range is from 6060 – 6069 partner 3 from 6070 – 6079 etc.

Because the original ledger code structure didn't distinguish between capital and current accounts we made the decision to initially move what were the original partners’ accounts to the partners’ current accounts. As can be seen in the table above an existing balance in account 6050 has been moved to account 6053 a balance in 6051 has moved to 6054 and balances in 6052 and 6054 have moved to 6056 and 6057 respectively.

Balances have moved in the current and previous year(s) and you will notice in both the journal entry screen and the ledger reports the account codes have changed but the original account/transaction description remains.

If you wish to run both a capital and current account you should make journal entries to adjust the balances on the capital and current ledger codes for each partner.

Automatic Naming of Ledger Codes With the Partner's Name

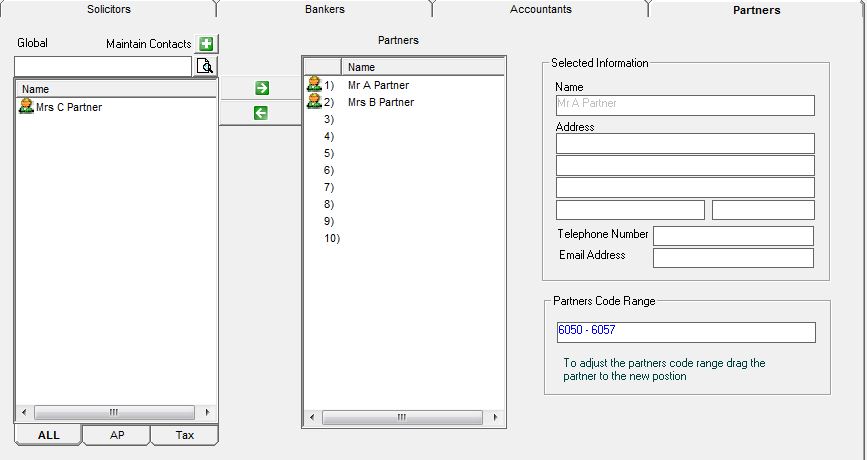

As you add a partner to a set of accounts you now assign them to a range of ledger codes (as described above). Maintain / Partners looks like this:

Partners allocated to this partnership are shown in the Partners column (in the centre of the screen) unallocated partners appear in the left hand column. To allocate a partner click the partner in the left column and click the right pointing arrow to move them to the Partner column.

As described above each partner has a range of balance sheet ledger codes these can be seen by clicking the partner and viewing the partner's code range on the bottom right of the screen. As you allocate a partner the system will automatically assign the next partner number and the code range associated with it the system will also add the partner's name to the accounts in the range. For example Mr A Partner is partner 1 in the screen shot above the system will assign him to code range 6050 - 6057. The ledger codes will also carry his name - Mr Partner A - Capital account b/fwd etc.

When you initially open a set of existing partnership accounts you will be prompted to confirm the positioning of the partners. The system will assume the first partner in the list is partner 1 the second in the list partner 2 etc. You can change the positioning of the partners by dragging the partner as they appear in the Partner column to the correct position. It is important to note that the system does not move balances in the ledger; this needs to be done by a journal posting.

Partners' Salaries

Partners' salaries are treated as an appropriation of profits therefore they should not be posted to the ledger although ledger codes do exist they should be ignored. You specify a salary per partner and the system will automatically allocate it prior to the distribution of profits in the profit sharing ratio. Here is an example: Two partners share profits equally in the ratio 50/50 partner A is also entitled to a £10000 salary profit for the year is £32000 the appropriation account will look like this:

Net profit as per accounts £32000

Deduct salary: Partner A £10000

Share of balance:

Partner A £11000

Partner B £11000

To assign a salary to partners click Maintain / Partners click the partner and enter the salary in the Salary field to the right of the screen:

Partners' salaries appear in the appropriation account and also in the partners' current accounts where they are added to the appropriation of profit for the year (they don't appear as a separate item).

Losses

Losses are allocated in the original profit sharing ratio.